|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

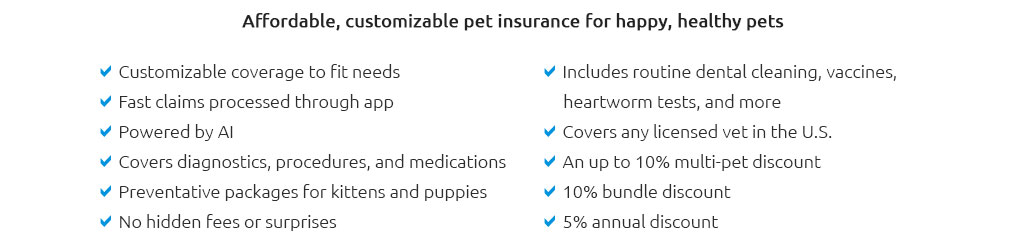

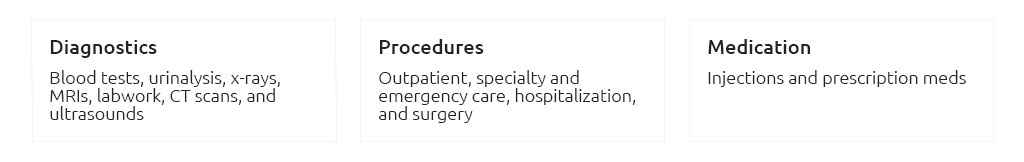

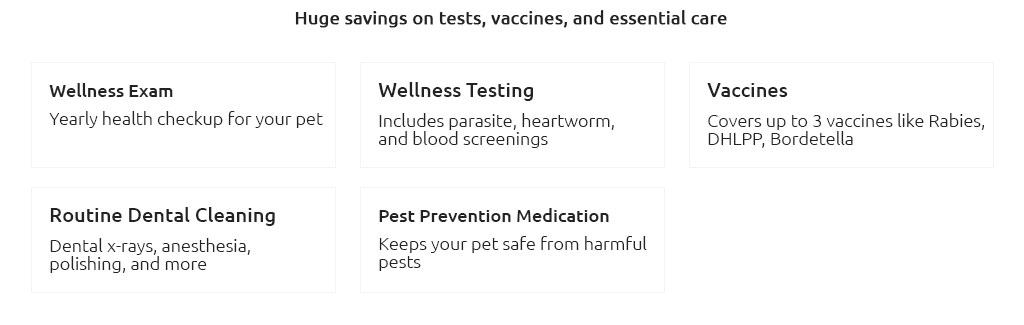

dog insurance for pitbulls: what owners should knowWhy coverage mattersPitbulls are energetic, loyal companions, but their strength can mean higher medical bills after sprains, skin issues, or emergency care. Insurance spreads risk so a single accident doesn’t crush your budget, and some policies include behavioral therapy and third-party liability. Policy features to compareCore benefitsLook for accident and illness coverage, exam fees, diagnostics, and prescription meds. An annual limit of $10k–$20k with 80–90% reimbursement suits many households; adjust the deductible to balance premiums. Breed and age considerationsSome carriers exclude certain breeds or raise rates. Choose insurers that underwrite by individual health, not stereotypes, and enroll before pre-existing conditions appear. Ask how they define a “bilateral condition.”

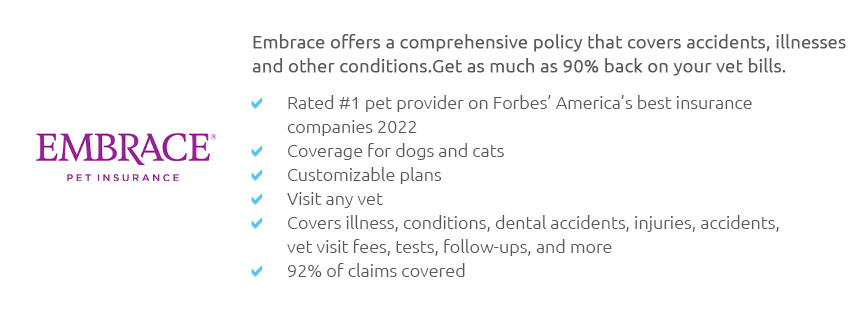

For savings, bundle pets, pay annually, and keep records of vaccines and training. A well-structured plan lets you focus on your pitbull’s health, not the bill. https://www.embracepetinsurance.com/breed/pit-bull-pet-insurance

For comprehensive accident and illness coverage, the majority of our Pit Bull pet parents pay between $39 and $86 per month. https://www.reddit.com/r/pitbulls/comments/tfwq8a/does_anyone_have_pet_health_insurance_here_and_if/

We have Banfield. It's not all encompassing insurance, but it is the best dang thing ever. Bi-annual check ups, shots, and teeth cleaning are all covered 100%. https://www.xinsurance.com/blog/pit-bull-liability-insurance/

Often, homeowners insurance does not cover pit bulls. Regardless of whether a pit bull may affect your home insurance, you should let your insurer know you have ...

|